Article - MLPs, Oil, And Micro Caps Among Top 10 Asset Classes For June

MLPs, Oil, And Micro Caps Among Top 10 Asset Classes For June

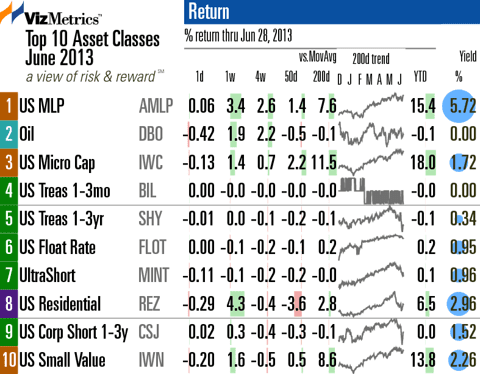

As part of our ongoing analysis of 59 global asset classes, we've identified the asset class performance leaders for June, based on total percent return for the month. We use leading ETFs as proxies for our asset class analytics.

Given the volatility this past month, which asset classes came out on top? Master Limited Partnerships (AMLP), Oil (DBO), and U.S. Microcaps (IWC) lead the pack.

U.S. Master Limited Partnerships

This was the #1 asset class in June, using AMLP as the ETF proxy for U.S. MLPs. In addition to strong June performance, AMLP is up 15.4% year-to-date, which beats the S&P 500 and the Dow Jones Industrial Average. In terms of momentum, AMLP crossed its 50-day moving average in June and is now 7.6% above its 200-day moving average.

Oil

Looking at DBO, our ETF proxy for the oil asset class, we see that despite a strong June (up 2.2%) DBO is essentially flat year-to-date (down 0.1%). Looking at momentum, DBO is close to its 50-day moving average (currently 0.5% below) and its 200-day moving average (currently 0.1% below).

U.S. Micro Caps

IWC, our ETF proxy for U.S. micro cap stocks, rounds out the Top 3 asset classes for the month. IWC was up just 0.8% in June, but IWC has been the No. 1 asset class performer year-to-date among 59 global asset classes, with a return of 18% through June 2013. IWC is still well above its 200-day moving average, but it has slipped from 13.1% above the 200-day simple moving average in May to 11.5% above in June.

To see the full list of all 59 Global asset classes with June returns, please visit Asset Class Returns for June 2013.

Top 10 asset classes for June 2013

(based on total % return for June)

- U.S. MLP [AMLP]: 2.9%

- Oil [DBO]: 2.2%

- U.S. Micro Cap [IWC]: 0.8%

- U.S. Treasuries 1-3mo (NYSEARCA:BIL): 0.0%

- U.S. Treasuries 1-3yr (NASDAQ:SHY): -0.1%

- U.S. Float Rate (BATS:FLOT): -0.2%

- Ultra Short (NYSEARCA:MINT): -0.2%

- U.S. Residential Real Estate (NYSEARCA:REZ): -0.4%

- U.S. Corporate Bonds Short Term 1-3y (CSJ): -0.4%

- U.S. Small Cap Value (NYSEARCA:IWN): -0.6%

Here's another view of the Top 10 asset classes for June, with a some additional metrics. This is a excerpt from Asset Class Returns for June 2013.

as published on

Disclosure: I am/we are long EFA, IWM, GLD, TLT, QQQ, SPY, EEM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.