2025 Tactical Portfolios, Gold Surge, and Fund Family Comparison

Top Tactical and Adaptive Allocation Portfolios, Gold’s Surge, and Fund Family Comparisons (July 2025)

Topics this month

- Tactical & Adaptive Allocation Portfolio Highlights: t.srqr, t.pure, t.aaae, and t.aaaf Risk-Return Trade-Offs

- Gold ETF Performance Review: GLD 20-Year Return, Risk, and Benchmark Standing

- Fund Insights & Major Fund Family Comparison: Vanguard, Fidelity, and iShares Funds with 10%+ Return and <40% Drawdown

Welcome to our July 2025 commentary covering portfolio performance, market insights, and strategy comparisons across major fund families. RecipeInvesting.com offers three subscription tiers to meet different investor needs. Our Free tier provides basic access to portfolio recipes and ingredients, while the Investor level offers full access to core features and analysis tools. The Pro tier represents our premium offering with comprehensive analysis for major fund families including Vanguard, Fidelity, iShares, and American Funds, along with all features from the investor subscription.

Tactical & Adaptive Allocation Portfolio Highlights

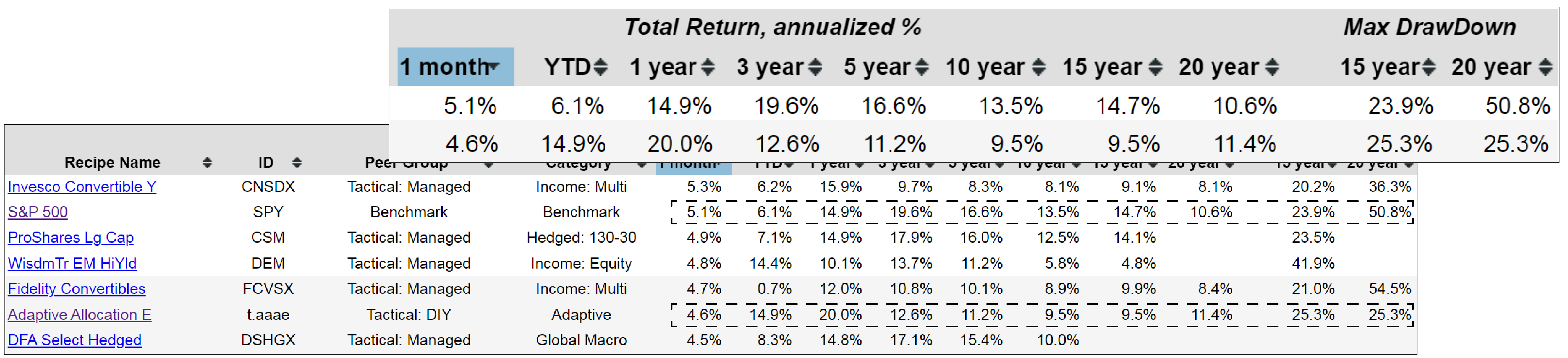

When viewing portfolio recipes sorted by one-month performance, two tactical strategies stood out: Quartile Sector Rotation (t.srqr) and Pure Momentum (t.pure).

These "t." portfolios are tactical investment models, updated monthly using algorithm-driven asset selection. As concentrated strategies, they typically allocate entirely to a single ETF or mutual fund each month. This approach introduces higher risk, but can also lead to strong returns over time.

The Pure Momentum portfolio, for example, delivered an impressive 15.3% annualized return over the past 20 years, despite a maximum drawdown of 34.9%. That drawdown also represents the worst loss over the past 15 years, underscoring the importance of long-term perspective.

Although t.pure has underperformed over the past year relative to major benchmarks such as S&P 500 (SPY) and a balanced portfolio, its 20-year track record remains robust. The model’s strength lies in its simplicity: it selects one ETF per month based on momentum and holds it until the next rebalance.

The t.srqr strategy has also delivered solid long-term results, although it lacks a full 20-year history due to limited data on one of its ingredients. Over the past year, t.srqr declined by 11.9%, though prior years saw strong momentum with double- and even triple-digit returns.

Another notable strategy is Adaptive Allocation E (t.aaae), one of six adaptive allocation models on the platform. Each variant adjusts based on different lookback periods and fund selection criteria. t.aaae, for instance, requires a minimum number of holdings and balances momentum with volatility.

Performance metrics for t.aaae are as follows:

- 1-Month: +4.6%

- Year-to-Date: +14.9%

- 20-Year Annualized Return: +11.4%

- Maximum Drawdown: ~25.3%

Compared to the S&P 500 (via SPY), t.aaae offers superior long-term performance with significantly reduced drawdown, particularly during periods such as the 2008 financial crisis.

Applying a filter for portfolios with at least 10% annualized return over the past 20 years and maximum drawdown below 40% reveals several options within RecipeInvesting’s tactical and adaptive lineup:

- t.aaaf – 14% return, 18.9% drawdown

- t.aaad – Slightly lower return, slightly higher drawdown

- t.aaae – Balanced return and drawdown profile

- t.shar (Maximum Sharpe) – Over 10% return, 22% drawdown

- BRK.A (Berkshire Hathaway) – Strong return but nearly 45% drawdown

These strategies emphasize different blends of risk and return. The adaptive allocation models in particular rely on dual calculations—using momentum to identify strong assets and risk metrics to reduce exposure. This flexibility enables them to adjust to changing market conditions.

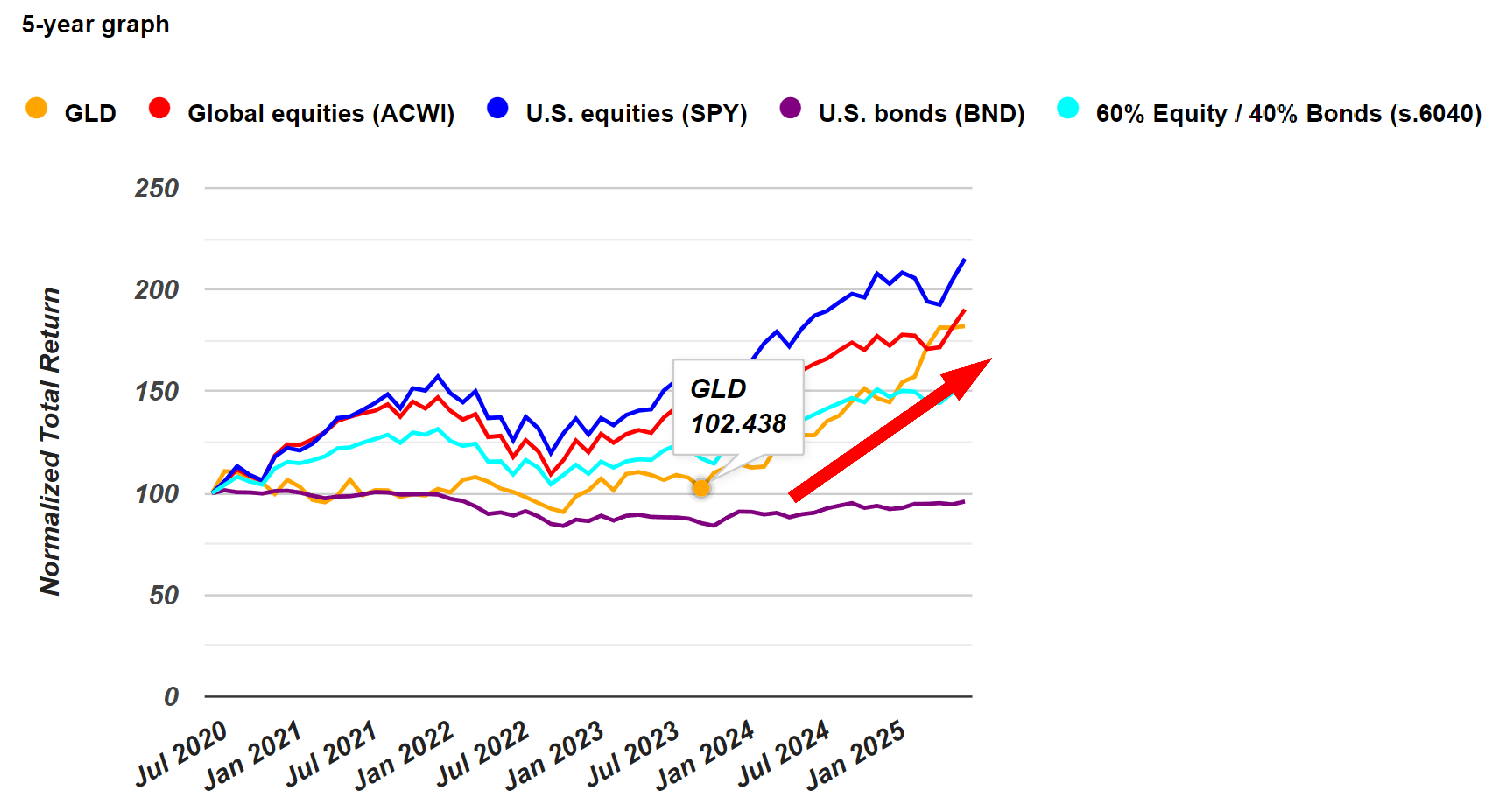

Gold ETF Performance Review

Gold has been gaining attention in recent headlines. The SPDR Gold ETF (GLD) recorded a modest 0.4% return over the past month but surged 26% over the past year. However, investors should be aware that GLD has also experienced a maximum drawdown of approximately 43% over the past 15 years.

Long-term investors in gold would have seen minimal returns between 2018 and late 2023, followed by a sharp rebound. Over a 20-year period, GLD returned 10.2% annualized—respectable, though still trailing the S&P 500.

On a 20-year risk-return scatter plot, GLD closely aligns with the S&P 500 in terms of downside deviation, but underperforms over shorter horizons such as 15 years. A comparison with iShares’ Gold ETF (IAU) reveals similar performance, confirming that both funds track closely.

Fund Insights Major Fund Family Comparison

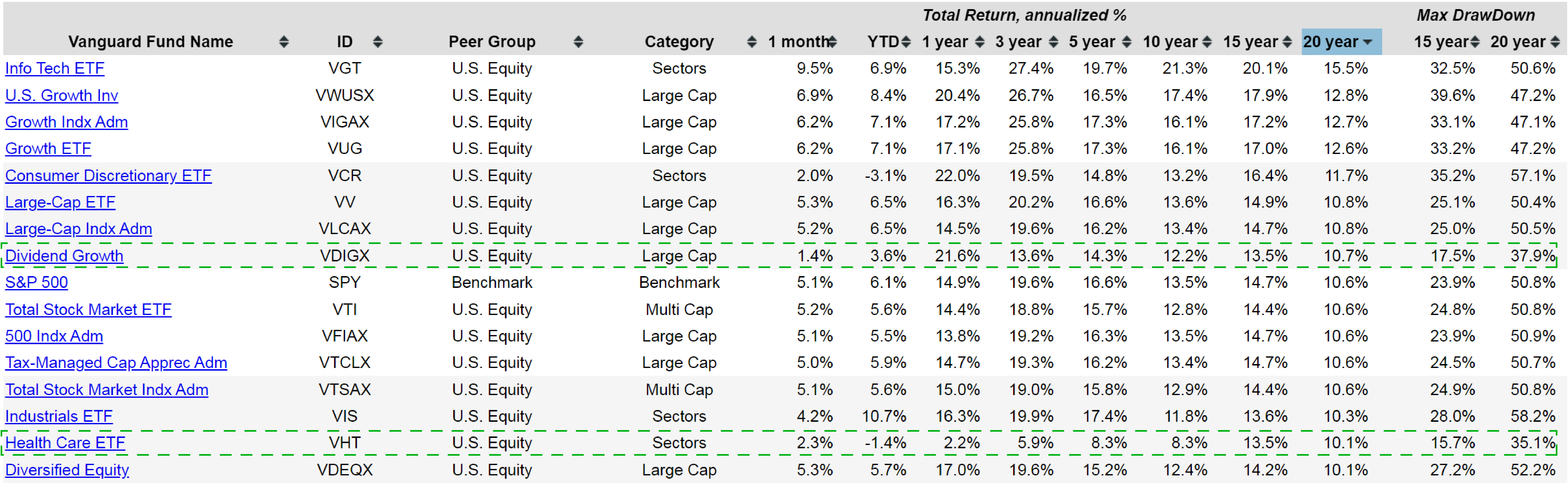

Vanguard Funds

Vanguard is a completely different story compared to Fidelity - and not in a good way if you're looking for safer high-return options. Where Fidelity gave us 18 funds to choose from, Vanguard barely scrapes together 2 that meet our criteria.

Vanguard has plenty of funds hitting that 10%+ return target (ranging from 15.5% down to 10.1% over 20 years), but here's where it gets ugly - most of them got absolutely hammered during market downturns. We're talking 50%, 57%, even higher drawdowns. Basically, if you owned these funds during something like 2008, you watched half your money disappear.

The Only Two Survivors:

- Dividend Growth Fund (VDIGX)

- About 10% returns over 20 years

- 37.9% drawdown (still painful, but manageable)

- Actually did well recently with 21.6% over the past year

- The dividend focus seems to provide some cushion during rough times

- U.S. Health Care ETF (VHT)

- Around 10% long-term returns

- 35.1% drawdown

- Currently struggling (down 1.4% this year)

- Faces potential trouble from government regulation changes

Most of Vanguard's appealing funds - growth, consumer discretionary, large cap growth - they all look great on paper until markets crash. Then they drop 40-50%+ and suddenly that "steady long-term growth" doesn't feel so steady.

Vanguard seems built for people who can stomach big swings and just want to ride the broad market. If you're looking for growth with some downside protection, you're pretty much stuck with dividends or healthcare - and even those aren't exactly smooth sailing.

Fidelity Funds

Fidelity demonstrates significantly more diversity within this filtered range compared to Vanguard, offering 18 funds that meet the criteria versus Vanguard's mere 2 funds. This broader selection stems primarily from Fidelity's extensive range of sector-specific funds, providing investors with more targeted investment opportunities.

The analysis reveals a clear performance hierarchy, with returns ranging from 18% down to the 10% cutoff threshold. Notable standout funds include:

Technology Services to Large Enterprises - The top performer, likely benefiting from the consistency and stability of selling technology services to large enterprises, which appears more resilient and less prone to significant drawdowns compared to broader technology investments

Select Medical Technology & Devices (FSMEX) - A healthcare-focused fund that capitalizes on the medical technology sector's growth potential

Select Pharmaceuticals (FPHAX) - Another healthcare play with a 35% maximum drawdown, representing the pharmaceutical industry's investment opportunities

The results highlight an interesting pattern where technology and healthcare sectors dominate the qualifying funds. However, there's a notable distinction within technology investments - more specialized areas like technology services to large enterprises show greater stability compared to broader technology funds or software/IT services, with the latter experiencing drawdowns as severe as 48% within the 20-year period.

Fidelity's success in this analysis appears to stem from their broader breadth of sector-specific funds, allowing for more granular investment strategies that can better balance returns with risk management compared to more generalized fund approaches.

iShares Funds

The iShares analysis reveals the most challenging landscape for investors seeking risk-adjusted returns. After examining Fidelity (18 qualifying options) and Vanguard (2 limited options), iShares presents zero funds meeting the established criteria. iShares offers numerous ETFs achieving 10%+ returns over 20 years, demonstrating strong long-term performance capability. However, when examining drawdown metrics, the results prove disappointing. Maximum drawdowns consistently reach 49%, 50%, and 51% across the board, with even the best-performing fund registering a 42% drawdown.

Once again, gold emerges as the nearest approximation to meeting the criteria. While the precious metal has demonstrated strong recent performance, it still fails to achieve the sub-40% drawdown threshold required for qualification.

This comprehensive analysis across the three major fund families demonstrates the inherent difficulty of identifying investments that deliver solid returns while maintaining reasonable downside protection during market volatility. Investors committed to working within these established fund families face limited options:

- Healthcare investments (accepting regulatory risk exposure)

- Technology sector funds (tolerating higher volatility)

- Dividend-focused strategies (accepting potentially more modest returns)

The scarcity of qualifying options across traditional fund families highlights the potential value of tactical portfolio management approaches. Alternative investment strategies that employ active risk management techniques have demonstrated the ability to achieve returns in the teens while maintaining lower drawdown profiles—a combination that traditional fund families struggle to deliver consistently.

Conclusion

Across this month’s analysis, several insights emerged:

- RecipeInvesting's tactical and adaptive portfolios remain strong candidates for investors seeking favorable long-term returns with controlled risk.

- Traditional fund families offer some strong options, though typically with higher historical volatility.

- When applying a 10% return / 40% drawdown filter, RecipeInvesting strategies offer a broader and more balanced set of choices than most indexed funds.

Blending strategies—such as combining a momentum model with an adaptive allocation approach—can help investors find a more optimal position on the risk-return spectrum. As always, historical returns and drawdowns are only part of the picture. Strategic allocation, adaptability, and investor discipline remain essential to long-term success.