2025 Gold Strength, Energy Weakness, and Fund Insights Analysis

Gold Strength, Energy Weakness & Fund Insights Analysis (May 2025)

Topics this month

- Gold (GLD) Strength: Strong performance and momentum amid market uncertainty

- Energy Weakness: Ongoing underperformance in oil, MLPs, and metals.

- Portfolio Spotlight: Active Combined Asset (t.acap) and Maximum Sharpe Portfolio (t.shar): Tactical gold exposure and strong risk-adjusted return strategies

- Fund Insights: New Pro tool highlights top vs. bottom fund performers

Welcome to the May 2025 edition of Recipe Investing commentary! Each month, we provide timely updates and insights to help investors navigate the ever-changing investment landscape. Please note that the Recipe Investing website is refreshed with new data at the end of each month—typically around the first—featuring the latest tactical and strategic portfolio recipes and ingredients based on current market conditions.

This Month's Market Performance

Looking at the poorest performers this month, we see several commodity-related funds:

Interestingly, several of these investments have shown negative performance even over a 15-year timeframe, highlighting the importance of tactical timing when dealing with commodity funds.

On the positive side, several investments have performed exceptionally well:

- Mexico (EWW) has thrived despite potential tariff concerns

- Swiss Franc (FXF) currency fund

- European country funds including Belgium (EWK), Spain (EWP), and Germany (EWG)

Gold Performance

Gold has been a standout performer at 5.4% for the month. Looking at the year-to-date figures, the SPDR Gold Trust (GLD) has shown remarkable strength during recent market uncertainty.

The five-year graph reveals gold's impressive trajectory:

- Initially flat or slightly down (95.6 relative to starting at 100)

- Followed by a rapid ascent over the past 2-2.5 years

Model Portfolio Analysis

Our model portfolios include tactical, strategic, and managed portfolios with regular tickers. Examining the one-month performance:

Some tactical portfolios have underperformed, potentially due to momentum shifts not in their favor. For example, Faber Relative Strength: Top 1 (t.frs1) has struggled recently despite strong 20-year performance.

Our top performers include Maximum Sortino Portfolio (t.sort) and Maximum Sharpe Portfolio (t.shar) tactical portfolios showing:

- 5.4% growth over the past month

- 10%+ annualized returns over 20 years

Portfolio Highlight: Maximum Sharpe Portfolio (t.shar)

This portfolio uses the Sharpe ratio (measuring return per unit of standard deviation) and has consistently outperformed the Sortino ratio portfolio across nearly all time periods. While standard deviation counts both upward and downward volatility, this portfolio has delivered:

- Steady upward trajectory recently

- Solid 20-year returns with a different risk profile than the S&P 500

Portfolio Highlight: Active Combined Asset (t.acap)

This sophisticated portfolio:

- Uses momentum methodology based on maximum adjusted price over 6-12 months

- Can allocate up to one-third to gold based on market conditions

- Has delivered 23.5% returns over the past year

- Shows 8.3% annualized returns over 20 years with only a 25% drawdown (compared to S&P 500's 50% drawdown)

Fund Insights – A Pro Subscription Feature

The new Fund Insights dashboard, available through the Pro subscription, extends RecipeInvesting’s analytical framework to major fund families, including iShares and Vanguard. This feature allows investors to evaluate ETFs and mutual funds using the same data-driven methodology applied to portfolio recipes, offering a more comprehensive view of risk and return.

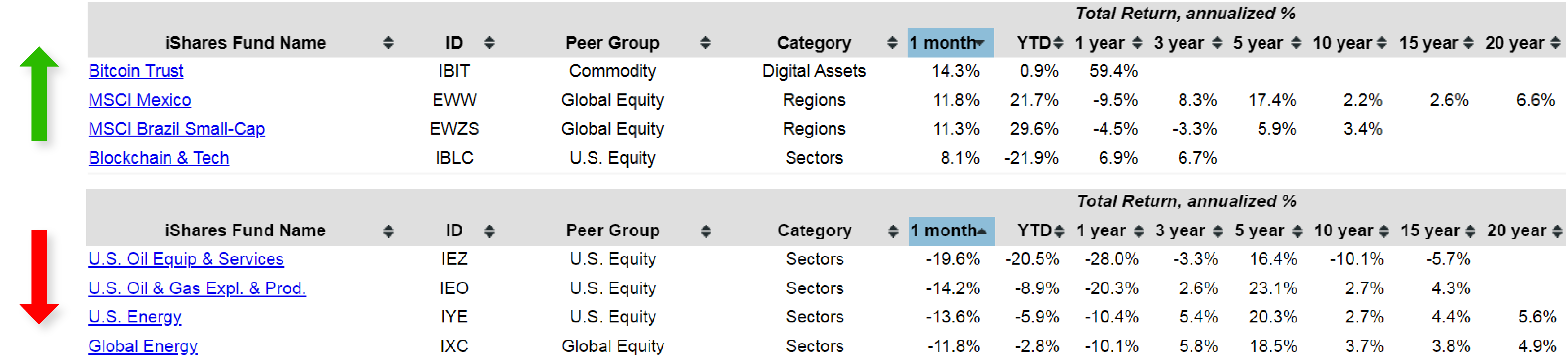

iShares Analysis Highlights

- Bitcoin Trust (IBIT): Up 59.4% over the past year, leading the pack.

- Energy ETFs remain among the worst performers, mirroring broader market trends.

- Semiconductors (SOXX): Despite a rough patch, the 20-year return remains strong at 14%, but with a substantial 60% drawdown.

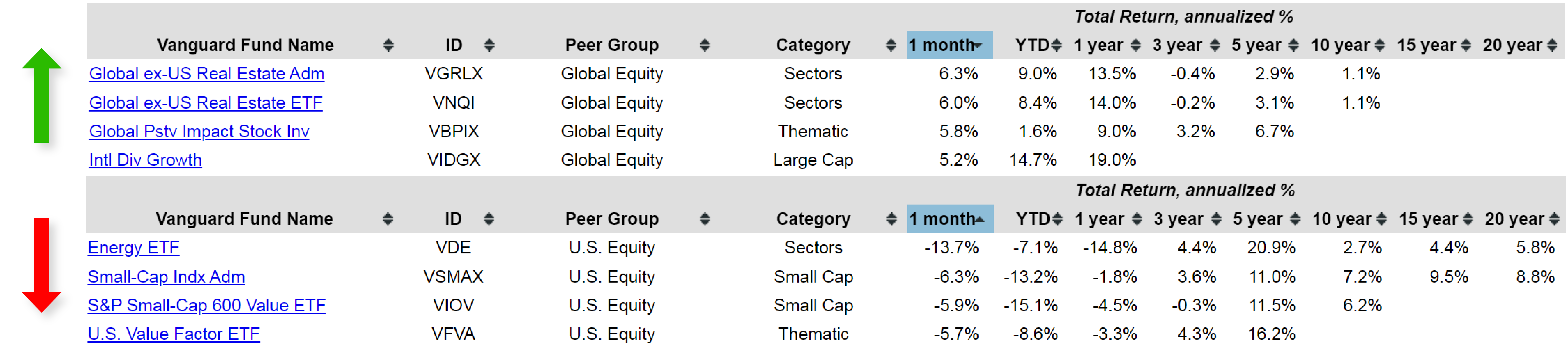

Vanguard Analysis Highlights

- Energy ETF (VDE): This fund has been the worst-performing Vanguard ETF over the past month, reflecting ongoing weakness in the energy sector amid broader market headwinds.

- Global ex-U.S. Real Estate (VNQI): Despite long-term underperformance, VNQI emerged as a one-month standout, posting unexpected gains. While its 10-year return remains a modest 1.1%, its recent performance suggests a potential shift in investor sentiment toward international real estate assets.

The analysis reminds us that optimizing risk and return simultaneously typically requires tactical allocation rather than index-based ETFs.

Key Takeaways for May 2025

Gold continues to shine amid market uncertainty, maintaining its upward momentum as a reliable asset during volatile periods. Tactical portfolios also present compelling opportunities, particularly those utilizing the Sortino Ratio to focus on downside risk while aiming for strong risk-adjusted returns. Additionally, the newly introduced Fund Insights dashboard offers deeper ETF analysis across major fund families, now accessible through the Pro subscription.